February 20, 2025

RED FM News Desk

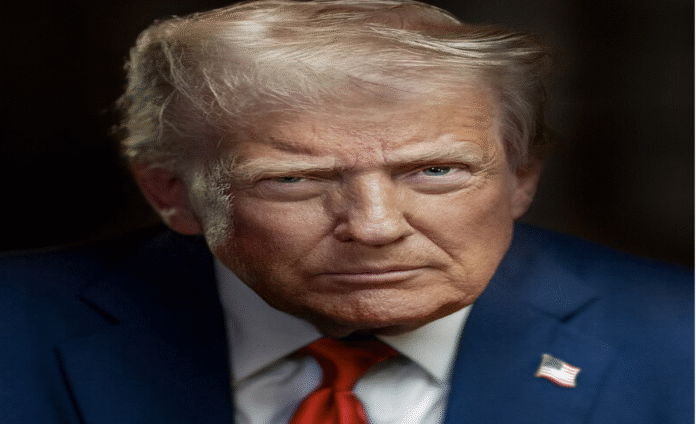

In a significant legal blow to the administration’s trade policy, the U.S. Supreme Court ruled 6-3 on February 20, 2026, that President Donald Trump overstepped his constitutional authority by using emergency laws to bypass Congress and unilaterally impose global tariffs. The majority opinion, authored by Chief Justice John Roberts, clarified that while the International Emergency Economic Powers Act (IEEPA) allows the president to regulate trade during a national emergency, it does not grant the power to set or collect taxes, an authority the Framers reserved exclusively for the legislative branch. This ruling effectively invalidates billions of dollars in “Liberation Day” duties and fentanyl-related levies that had been applied to imports from Canada, Mexico, and China.

The court’s decision relied heavily on the “major questions doctrine,” asserting that the executive branch cannot rely on vague or ambiguous language in a statute to justify actions of vast economic and political significance. By rejecting the administration’s claim that trade deficits and fentanyl trafficking constituted an “emergency” sufficient to trigger taxation powers, the court reasserted the separation of powers. However, the ruling specifically returns the case to the lower courts to resolve the logistical nightmare of refunding an estimated $160 billion in illegally collected revenue.

Within hours of the stinging rebuke, President Trump signaled he would not abandon his protectionist agenda. During an emergency White House briefing, he announced a new executive order to impose a 10 percent global tariff under Section 122 of the Trade Act of 1974. This law allows the president to take temporary measures to address large and persistent balance-of-payments deficits. Unlike the broad IEEPA authority, Section 122 carries a strict 150-day limit, after which the tariffs must be extended by an act of Congress to remain in effect. Trump described the court’s ruling as a “disgrace” and vowed that his “Plan B” would ultimately collect even more revenue than the invalidated measures.

Industry experts and legal scholars warn that the transition to this new legal framework may trigger fresh rounds of litigation and market volatility. While the 10 percent levy is designed to be a baseline, it remains unclear how it will interact with existing sector-specific duties. Crucially, the Supreme Court ruling does not affect tariffs imposed under Section 232 (national security) or Section 301 (unfair trade practices). This means that higher duties on Canadian steel, aluminum, and automobiles, as well as separate tariffs on Chinese electronics, remain fully operational.

For Canada and Mexico, the ruling provides a temporary reprieve from the broad reciprocal tariffs, but the threat to North American supply chains persists. While CUSMA-compliant goods had previously received some exemptions, the new global baseline tariff could potentially strip away those protections unless specific carveouts are negotiated within the next 72 hours before the order takes effect. The Canadian Chamber of Commerce has already urged the federal government to prepare for “blunter mechanisms” as the administration seeks to rebuild its “tariff wall” through more legally sustainable, albeit temporary, avenues.