July 2, 2025

Parteek Singh Mahal

SURREY, B.C. – Taxpayers who have already paid the now-defunct Digital Services Tax (DST) will need to await new legislation from Ottawa before they can receive their refunds, according to the Canada Revenue Agency (CRA).

Prime Minister Mark Carney announced late Sunday that Canada was dropping the tax on global tech giants in an effort to restart trade negotiations with the United States.

The initial payment for the DST was due on Monday and could have cost American companies like Amazon and Uber billions of dollars.

A CRA spokesperson confirmed that the agency had collected some revenue from the Digital Services Tax prior to the government’s reversal, though no specific amount was disclosed.

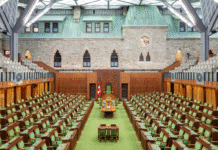

With Members of Parliament currently on their summer break, the spokesperson stated that legislation formally revoking the tax will need to be passed when Parliament reconvenes to enable taxpayers to receive their money back.

In the interim, the CRA has waived the requirement for taxpayers to file a DST return before the June 30 deadline and will not request any related payments.